AI-Enhanced FinOps: Key to Cutting Cloud Expenses

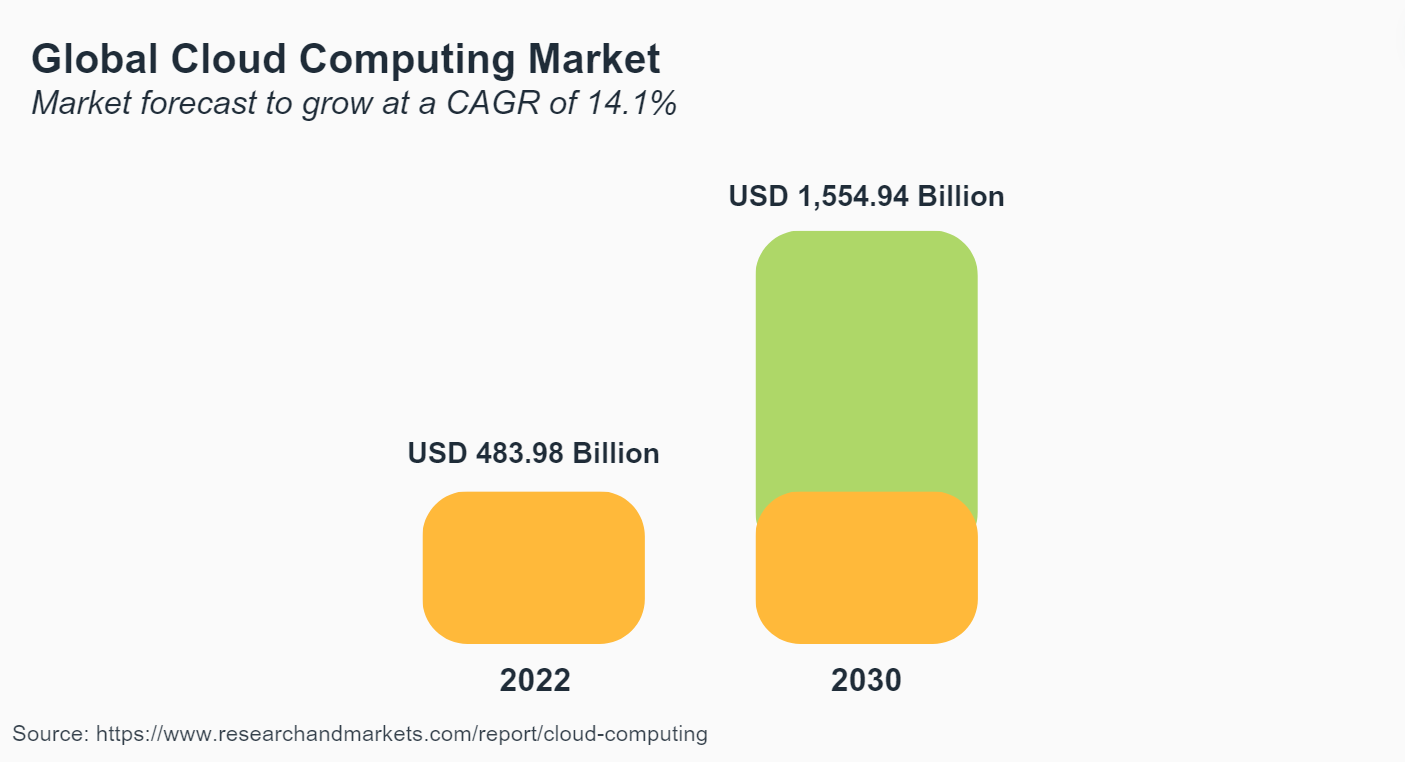

Cloud costs are skyrocketing – predicted to reach $1.5 trillion by 2030 – but AI-powered FinOps can help you slash them by up to 40%.

AI is the Future of FinOps: 69% of business leaders identify AI as the most radically important technology in the history of FinOps.

Cut Cloud Costs & Boost ROI: AI automates FinOps tasks, analyzes usage patterns, and identifies cost-saving opportunities. Businesses like Arabesque AI reduced server costs by 75% with AI.

Gain Real-Time Insights: Microsoft Tokyo’s use of AI in cloud FinOps predictive analysis allowed them to reduce their forecasting team from 60 individuals to just 2.

The rise of cloud technologies has acted as a radical turning point in business operations over the last few decades. As cloud technologies became more integrated into operations, worldwide spending skyrocketed. Global spending on cloud infrastructure services rose 19% in 2023, reaching $679 billion in 2024.

Cloud financial operations (FinOps) is the expanding discipline of managing cloud infrastructure by maximizing the ROI of investments in this segment. FinOps strategies pinpoint cost-saving opportunities that allow businesses to get more from their cloud infrastructure. Yet, the dynamic nature of cloud demand, usage, and pricing structures have made cloud FinOps increasingly complex.

In this context, artificial intelligence (AI) emerges as a transformative force in FinOps. AI offers the potential to identify actionable insights to promote cost savings, optimize cloud spending, and enhance resource optimization. A survey of 200 enterprises shows that 69% of industry leaders believe AI is the most impactful technology on FinOps in history.

With cloud spending predicted to reach $1,559.94 billion by 2030, there has never been a more important time to integrate AI in FinOps. This article will explore how AI reduces cloud budges while enhancing processes and outline how your business can adopt AI in FinOps.

AI in FinOps: Boost Efficiency & Reduce Errors

AI-driven FinOps is the practice of incorporating artificial intelligence technologies to optimize financial cloud management. AI can automate several cloud FinOps practices across cost balancing, financial analysis, and allocation.

At its core, the ability to automate processes sets AI-driven FinOps apart from traditional FinOps. In conventional financial operations environments, the combined efforts of finance, DevOps, and IT teams help to optimize the system. This approach is time-consuming and prone to human errors that can add additional costs and reduce efficiency.

AI-driven FinOps mitigates these errors, leveraging machine learning and advanced algorithms to automate tasks, generate a constant influx of new actionable insights, and implement changes to enhance efficiency.

AI-driven financial operations offer the following advantages to cloud environments:

- Cost optimization: AI algorithms can analyze historical cloud usage patterns and cost data to identify opportunities for cost optimization. Automatically monitoring and adjusting cloud resource usage will save costs and maximize the ROI of cloud FinOps activities. Arabesque AI cut cloud server costs by 75% with AI-enhanced scaling.

- Improved forecasting accuracy: AI in FinOps analytics provides real-time data from cloud platforms. Using machine learning algorithms, AI FinOps can detect patterns, generate insight, and provide actionable insights to enhance operations.

- Automated governance: Cloud-first FinOps practices are far ahead of other companies that don’t use the cloud by around 40%, on average. Yet, AI-powered FinOps allows businesses to gain a competitive advantage in compliance by automating many of the most time-consuming stages.

Integrating AI into cloud FinOps helps enterprises gain a competitive advantage, reduce cloud costs, and optimize cloud processes to achieve higher returns.

How Microsoft Uses AI in FinOps to Cut Costs

Microsoft is a leader in using artificial intelligence to streamline FinOps and accelerate digital transformation. Over the past few years, the Microsoft finance team has worked to develop FINN (Microsoft FInance Time Series Forecasting Framework). Microsoft has increased revenue prediction calculations to 99% accuracy using this AI finance tool.

Sousa-Lennox, an engineer on the team, comments,

“The tool has helped this finance team achieve 99% accuracy in forecasting the revenue for an Azure product.”

Microsoft has deployed this model in its branches worldwide to astounding results. In Microsoft Tokyo, the finance team leveraged this tool to reduce the human resources needed to run these forecasting calculations. While achieving equal performance, the team reduced employee numbers from 60 to only 2 staff members.

By leveraging AI, Microsoft has streamlined forecasting, freed up staff for higher-value activities, and generated business value from more precise forecasting.

Future-Proof Cloud Spending with AI & ML Insights

Integrating artificial intelligence and machine learning systems into the cloud has provided businesses with a powerful method of reducing costs while improving efficiency. These technologies' ability to process historical data for analytics, detect strange spending patterns, and forecast future spending helps identify post-saving opportunities.

Mckinsey estimates that generative AI can reduce cloud spending costs by 40% while reducing management time and enhancing employee productivity.

Since 2019, the total revenue for AI processes in cloud data centers has increased from $2 billion to $24 billion. By 2026, experts predict this figure will reach $38 billion, representing a revenue increase of 1800%. The rapid adoption and expansion of cloud reflects the efficacy of these tools, with businesses adopting them to enhance cloud FinOps processes.

It provides resources to optimize efficiency while managing costs, which is the leading responsibility in cloud FinOps environments. AI systems that can analyze data, conduct predictive analysis, and automatically scale up or down systems in response to fluctuating workloads excel in proactive cloud FinOps management.

Yet, while expanding AI utility in industry, it’s important to remember that businesses cannot wholly replace human-first methods of decreasing cloud costs.

In a roundtable discussion of the future of FinOps, Sean Donaldson, CTO of Protera, outlined that “While AI enhances their effectiveness, human involvement remains essential.” Employees who can leverage AI tools will be able to increase productivity and gain complete cloud visibility.

As we’ve seen with Microsoft Tokyo, AI tools can radically reduce the number of workers needed to complete a task. However, human participation will help detect anomalies, AI hallucinations, and other potential errors that the tools will not detect.

From Staffing to Beds: AI Optimizes Hospital Ops

Public hospitals in Australia are saving over $2.5 million annually thanks to a powerful AI tool called the Patient Admission Prediction Tool (PAPT). This tool leverages artificial intelligence and cloud-based data analysis to optimize hospital financial management and resource allocation.

The Patient Admission Prediction Tool uses AI to analyze vast amounts of data, including historical patient records. This allows the tool to predict patient admissions far in advance, from hours to weeks or even a decade, with an accuracy of 95%. This foresight empowers hospitals to proactively plan and optimize their operations, leading to significant cost savings.

Hospitals are realizing millions of dollars in yearly savings with this AI-powered approach. Yet, this figure is only a small part of the total potential savings. Due to improved patient outcomes, future benefits could be as high as $80 million annually.

With this foresight, hospitals can proactively plan and optimize their resource allocation. This translates to cost savings in several areas, like staffing, bed availability, and inventory management.

20% Cloud Savings with Tangoe's AI-Driven FinOps

FinOps and AI form a powerful partnership only when businesses understand how to leverage AI to derive the most value in cloud environments.

James Parker, CEO of Tangoe, an AI-powered cloud solution, comments that business opportunities in cloud FinOps rely on “Quickly gaining complete visibility into service utilization and being able to precisely match cloud resources with business needs to reduce unnecessary spending.” The potential for AI systems to provide “real-time dashboards that connect IT operations, finance, and cloud financial management data in one platform” is invaluable.

Tangoe’s FinOps approach highlights the importance of data visibility when using AI tools. Full visibility into the cloud and complete integration with AI systems will streamline cloud management and drive profits. Tangoe’s visibility-first AI integration strategy led to cost savings of 20% or more in the cloud FinOps environments they manage.

Key Takeaway

Across cost savings, data efficiency enhancements, and infrastructural innovations, AI in FinOps has the potential to improve cloud systems management radically.

As artificial intelligence tools become more embedded in cloud architecture, they will continue to provide new opportunities to help companies thrive in the digital age. Enterprises that stay informed about emerging trends and continuously optimize AI solutions in this sphere will gain a vital competitive advantage.

.svg)

.svg)

_0000_Layer-2.png)